Empowering You

Financial Dreams

One Tradeline at a Time.

Empowering Your Financial Dreams, One Tradeline at a Time.

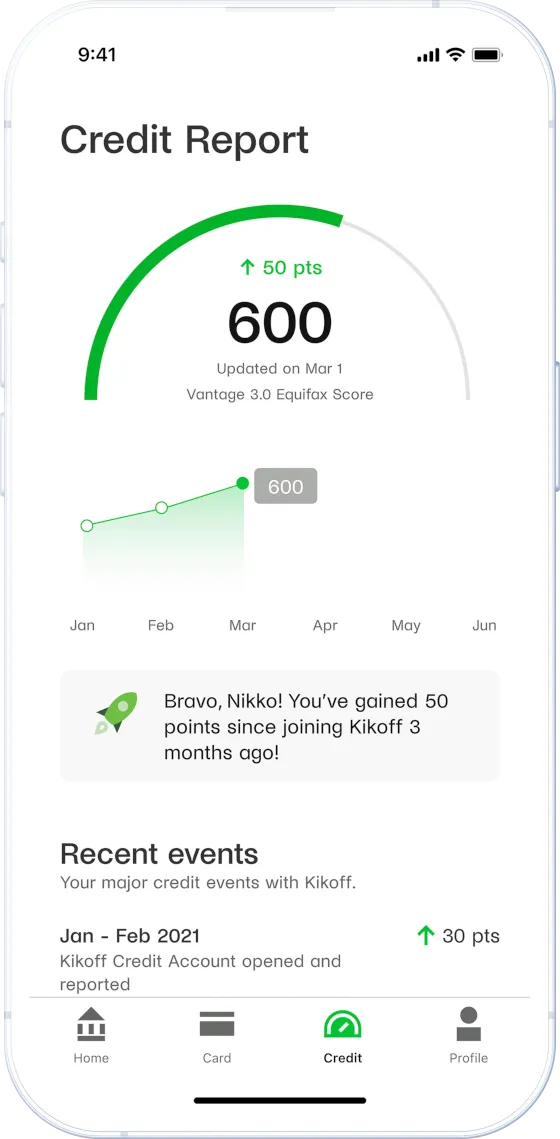

95% of TradelineBluprint members saw a credit score improvement in less than 14 days.

TradelineBlueprint helps people build better credit scores by making it ease to use authorized user tradelines and primary tradelines. We believe in fair chances for everyone to improve their credit, providing simple solutions for a big impact.

TradelineBlueprint helps people build better credit scores by making it easy to use authorized user tradelines and primary tradelines. We believe in fair chances for everyone to improve their credit, providing simple solutions for a big impact.

Empowering Your Financial Dreams

One Tradeline at a Time.

Empowering Your Financial Dreams, One Tradeline at a Time.

TradelineBlueprint helps people build better credit scores by making it easy to use authorized user tradelines and primary tradelines. We believe in fair chances for everyone to improve their credit, providing simple solutions for a big impact.

TradelineBlueprint helps people build better credit scores by making it easy to use authorized user tradelines and primary tradelines. We believe in fair chances for everyone to improve their credit, providing simple solutions for a big impact.

We Report to:

We Report to:

We Report to:

We Report to:

WHY

TRADELINE BLUEPRINT?

Millions of Americans could pay less in interest and fees with better credit scores.

Leveling the Credit Field with TradelineBlueprint

For many years, a common piece of advice for parents looking to give their children a financial leg up has been to add them as authorized users on their credit cards. However, this option isn't available to everyone, especially if the parents don't have strong credit themselves. Moreover, a comprehensive study involving 300,000 credit profiles found that about one-third of Americans have at least one authorized user tradeline, but it also highlighted a significant gap: minorities and people from lower economic backgrounds were less likely to benefit from such tradelines, underscoring the financial disparities that exist.

TradelineBlueprint steps in to bridge this gap by offering a chance for those who don't have the advantage of a family member or friend to add them as an authorized user. This approach is about leveling the playing field and providing equal opportunities for credit improvement across all demographics.

Looking for a more

Permanent option?

PrimeArchitect is changing the game by offering primary tradelines at lower prices. This means more people can afford to build a strong credit history. With a variety of options to fit different budgets, PrimeArchitect is making it easier for everyone to improve their credit, leading the way in makHeadlineing credit building more accessible.

Looking for a more

Permanent option?

PrimeArchitect is changing the game by offering primary tradelines at lower prices. This means more people can afford to build a strong credit history. With a variety of options to fit different budgets, PrimeArchitect is making it easier for everyone to improve their credit, leading the way in makHeadlineing credit building more accessible.

Join the Team

and become a BlueprintBuilder!

Join our team as a BlueprintBuilder and gain access to exclusive offers, including the opportunity to white-label our services. This partnership allows you to offer TradelineBlueprint's innovative solutions under your own brand, enhancing your business offerings and value to your clients.

FREQUENTLY ASKED QUESTIONS

What is a tradeline?

A tradeline is a record of a consumer's credit account on their credit report, including information about the creditor, the account type, the payment history, and the balance.

How do tradelines affect my credit score?

Tradelines can impact your credit score by influencing factors like your credit utilization ratio, payment history, and the age of your credit accounts. Positive tradeline information can boost your score, while negative information can lower it.

What's the difference between primary and authorized user tradelines?

Primary tradelines are accounts where you are the original borrower or account holder. Authorized user tradelines are where you are added to someone else's credit account, potentially benefiting from their credit history.

Can purchasing tradelines improve my credit score?

Being added as an authorized user to a positive, well-maintained tradeline can potentially improve your credit score. However, the impact varies depending on the rest of your credit profile.